About Vault Insurance & Risk Management

Languages Spoken

- English

All business insurance

All business insurance

Our agency specializes in Auto, Commercial, Farm, Home, Powersports, Condo, Renters, Agriculture insurance.

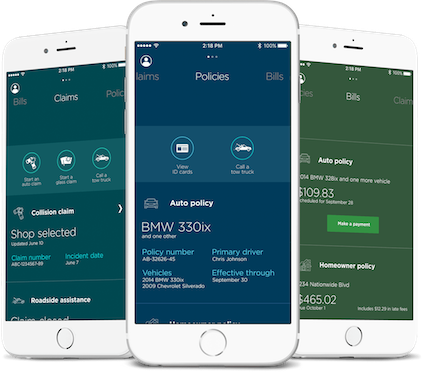

Your Nationwide Insurance ID card can be accessed here.

Whether you're changing vehicles or simply searching for better coverage this policy term, let Vault Insurance & Risk Management answer all your auto insurance questions. Our agents can ensure your policy meets all applicable NE requirements, while also pointing out areas where gaps in coverage may occur. We can help find your sweet spot between stronger coverage and affordable costs. You won't find a more knowledgeable, friendly source for personalized auto insurance in Lincoln.

Area drivers will quickly come to realize the value that Nationwide brings to the table. This includes everything from policy discounts to flexible billing options to the On Your Side® Claims Service. But it also includes personalized policy options and exclusive programs from Nationwide that are popular with other Lincoln drivers Vault Insurance & Risk Management serves. Vanishing Deductible®, for example, is a great way to reward yourself for each year you stay claims-free.

Our office address is 6221 S 58th St, but no matter which Lincoln zip code you park your car in, we can offer quick estimates and sound advice. Give us a call at (402) 261-3999. With one of our agents as your guide, it doesn't need to take all day to consider your choices.

Protecting your Lincoln property and family from loss is just one of the goals of a home insurance plan. Offering you peace of mind both now and in the event of a loss is one of our top priorities at Vault Insurance & Risk Management. That's why we help you assess your insurance needs before they arise by taking into consideration all the specifics that affect your situation. Many factors influence your need for coverage, including having a pool or detached buildings on your property. Vault Insurance & Risk Management will help you determine your needs and choose adequate coverage.

Our relationship with Nationwide allows us to offer you a variety of policies that enhance traditional coverage for both personal injury and loss. If you store high-value items at home, or have fine art you'd like to insure, we can help with Valuables Plus®, a program designed specifically for those special heirlooms or prized possessions. If you need to file a claim, we are here to help expedite the process and assist you in getting your home back to normal again.

Give us a call today at (402) 261-3999 to find out more information regarding programs that are right for your situation. Alternately, you can find a time to meet at our office located at 6221 S 58th St. Let us help you with bundling discounts, additional coverage, and a policy that will leave you worry-free

We all get insurance with the hope of never having to use it. While we at Vault Insurance & Risk Management can attest to Nationwide's outstanding claims resolution process, it's still incumbent upon every small business owner to do all that he or she can in terms of risk prevention. As the preferred insurer for many small businesses in the Lincoln area, Nationwide has seen just about every liability scenario that you can imagine. Fortunately for you, the folks at Nationwide use this experience as a resource to help you prepare to avoid these same issues afflicting your company.

What business owner doesn't have concerns about the safety and stability of his or her company, employees, and customers? If your risk potential is keeping you up at night, turn to Nationwide. They have a wealth of information for you on managing the risks associated with worker and customer safety, fire or equipment failure, and professional, product, or general liability. Putting this advice into practice can reduce your chances of needing to call upon your policy for assistance. Yet if you do need to rely on Nationwide for coverage, rest assured that you have the best team in the business handling your claim.

With Nationwide, you truly have an insurer that cares about your company's protection. Not only does it act as a resource for risk management strategies, but it will also be there to help you recover if and when an issue does arise. To learn more about safety and loss prevention or any other of the advice and services Nationwide offers, contact Vault Insurance & Risk Management by calling (402) 261-3999 and scheduling an appointment to come by our office on 6221 S 58th St.

Nationwide offers small business resources to help you strengthen your business, such as financial calculators and information and articles on marketing and cash flow management. Learn more at the Business Solutions Center.

The Vault Insurance & Risk Management also offers products in AZ, CO, MO, NE. Please call for information on products in those states.